FINANCIAL REVIEW

RECEIVABLES COLLECTIBILITY

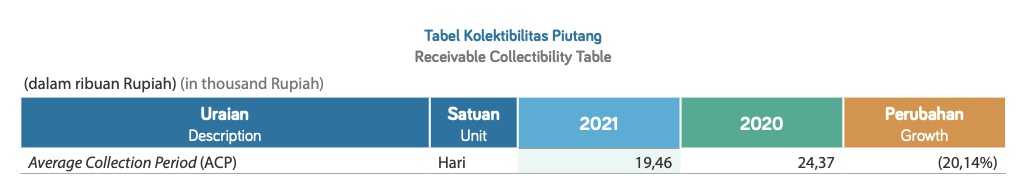

The receivables turnover ratio in 2021 reached 19.46 days, a decrease from 24.37 days in 2020. This is due to the receivables management and control functions in each region and subholding being carried out, and the implementation of PSAK 71.

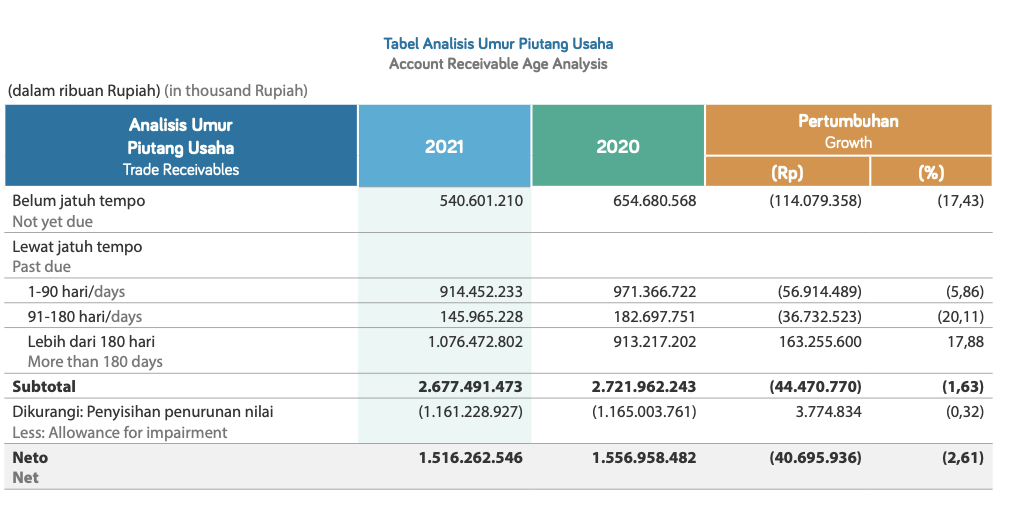

Total receivables not yet matured in 2021 amounted to Rp540.60 billion, greater than the number of receivables that are past due 91-180 days of Rp145.97 billion. This shows that the collectibility of receivables is still in the good category, and the Company can support its activities.

For December 31, 2021 and 2020, management believes that the allowances for expected credit losses on trade receivables is adequate to cover possible losses from uncollectible trade receivables. Management also believes that there is no significant concentration of credit risk on receivables from third parties.

CAPITAL STRUCTURE

CAPITAL STRUCTURE DETAILS

In 2021, Pelindo’s capital structure composition was 63.82% from liabilities, and 36.18% from equity. This composition has slightly changed when compared to 2020, where the capital structure composition from liabilities was 66.03 and equity was 33.97%.