FINANCIAL REVIEW

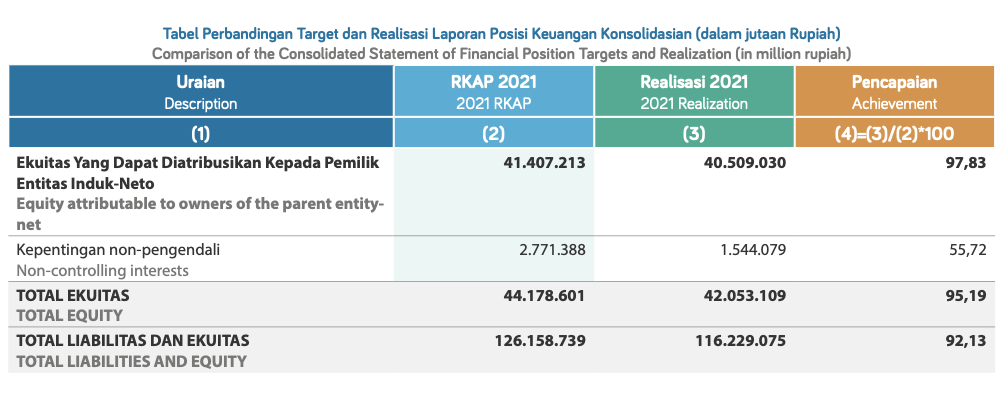

Based on the above data, total assets reached 92.13%, slightly below the RKAP target, with liabilities reaching 90.487%, and equity reaching 95.19%. However, current assets exceeded the RKAP target by 107.58%, mainly due to:

- Cash and cash equivalents of Rp12.92 trillion or 6.84% above the 2021 RKAP target of Rp12.10 trillion;

- Short-term investments of Rp5.72 trillion or 91.20% above the 2021 RKAP target of Rp2.99 trillion. This was mainly due to the higher deposit placements of more than three months compared to the 2021 RKAP;

- Other receivables - net of Rp1.28 trillion or 25.69% above the 2021 RKAP target of Rp1.02 trillion, mainly due to receivables from loans from the subsidiary PT Berlian Jasa Terminal Indonesia (PT BJTI) to PT Berkah Manyar Sejahtera Area (BKMS) as an associate entity; and

- Inventories of Rp217.68 billion or 4.67% above the 2021 RKAP target of Rp207.96 billion.

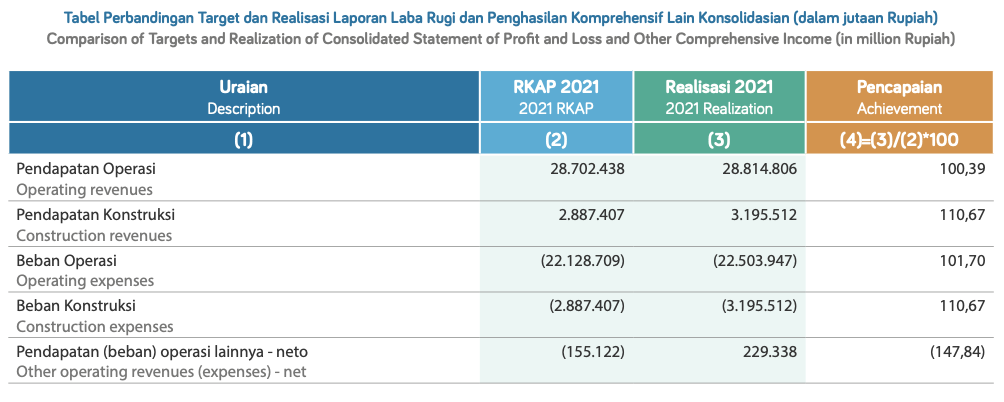

The comparison of targets and realization of the profit and loss statement and other comprehensive income is as follows: