FINANCIAL REVIEW

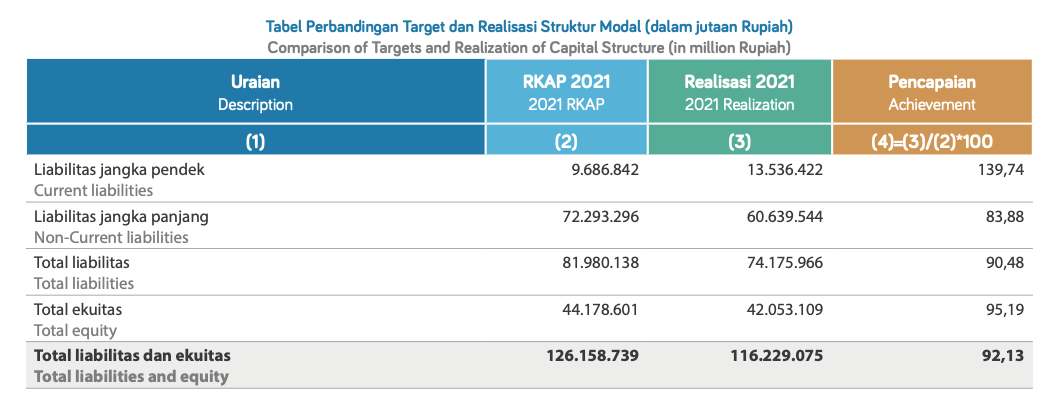

Total liabilities reached 90.48%, below the RKAP target, with total equity slightly below the target with 95.19%.

Short-term liabilities exceeded the RKAP target by 139.74%, this higher realization in 2021 was partly due to:

- A subsidiary loan for PT Electronic Data Interchange Indonesia (EDII) from Bank OCB NISP in the form of overdraft of Rp2.66 billion from a limit of Rp4.00 billion, and a demand loan of Rp2.53 billion from a limit of Rp15.00 billion;

- A significant increase in operating expenses as of December 31, 2021;

- The divestment of PTP1 and PMT not being realized, where the plan was that the proceeds would be used to pay off part of the bank loan; and

- The increase in down payments by service users for services, not being taken into account with services, resulted in an increase in operating income from financial instruments.

Long-term liabilities were below the RKAP target of 83.88%, partly due to:

- Deferred tax liabilities being below the RKAP due to adjustments of the time difference component in Pelindo I, Pelindo III, and Pelindo IV when they were merged into Pelindo II on October 1, 2021;

- Bonds payable of Rp40.18 trillion were 9.09% below the 2021 RKAP of Rp44.19 trillion, due to the rupiah exchange rate as of December 31, 2021 was Rp14,269 per USD, while for the 2021 RKAP the exchange rate was assumed at Rp14,600 per USD and the bonds credit not realized in Region I;

- The refinancing program for bank loans in several regions as part of the merger initiative and the unrealized loan plan in CTP and Regional I; and

- The lease liabilities were 85.71% below the RKAP, mainly due to the RKAP including realization in regional I for Belawan Phase II assets, as well as changes in several patterns of cooperation from fixed rental rates to revenue sharing.