FINANCIAL REVIEW

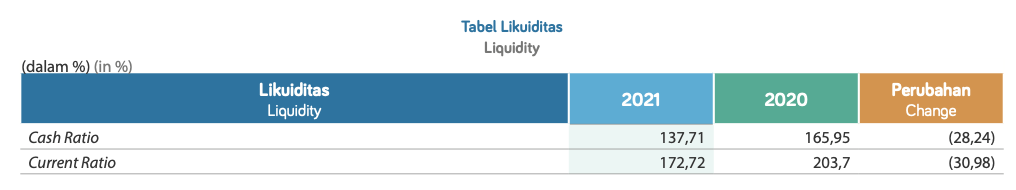

The Cash ratio in 2021 reached 137.71%, a decrease of 28.24% compared to 165.95% in 2020. The current ratio in 2021 reached 172.72%, a decrease of 30.98% compared to 203.7% in 2020. The decrease in the cash ratio and current ratio was due to the use of the Company›s internal cash for repayment of Bank loans in Regional I and Regional IV, and the use of internal cash for the acquisition of Cibitung Tanjung Priok Port Tollways.

ABILITY TO PAY LONG-TERM DEBT (SOLVENCY)

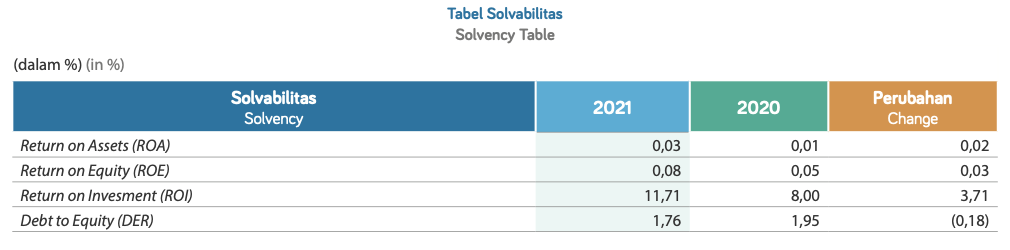

The solvency ratio shows the Company’s ability to pay its obligations, especially long-term liabilities. The solvency ratio is described as follows.

ROA in 2021 reached 0.03%, an increase of 0.02% compared to 0.01% in 2020. ROE and ROI increased to 0.08% and 11.71%, respectively. The increase in ROA, ROE and ROI was due to an increase in production flows in line with Indonesia›s economic recovery in 2021 from the decline in the COVID-19 pandemic. DER in 2021 reached 1.76%, down 0.18% compared to 1.95% in 2020. This was due to the settlement of Regional I and Regional IV debts.

ABILITY TO PAY DEBT FROM ISSUED SECURITIES

The ability to pay debts can also be reflected in the bond ratings, with bonds being routinely assessed by rating agencies to support the feasibility of bonds issued. The bonds are listed on the Singapore Stock Exchange and have received international ratings from the following rating agencies, Standard and Poor’s (S&P), Moody’s and Fitch and Pefindo.