STRUCTURE AND MECHANISM OF CORPORATE GOVERNANCE

PROCEDURE OF REMUNERATION DETERMINATION

The basis for determining remuneration for members of Board of Commissioners and Board of Directors is the authority of Shareholders and is determined in the GMS whose formulation refers to the Regulation of Minister of SOE No: PER-04/MBU/2014 dated March 10, 2014 concerning Guidelines for Determining the Income of Board of Directors, Board of Commissioners and Supervisory Board of SOE as has been amended several times, most recently by the Regulation of Minister of State-Owned Enterprises No: PER-13/ MBU/09/2021 dated September 24, 2021 on the Sixth Amendment to the Regulation of Minister of State-Owned Enterprises No. PER- 04/MBU/2014 concerning Guidelines for Determining the Income of Board of Directors, Board of Commissioners, and Supervisory Board of State-Owned Enterprises.

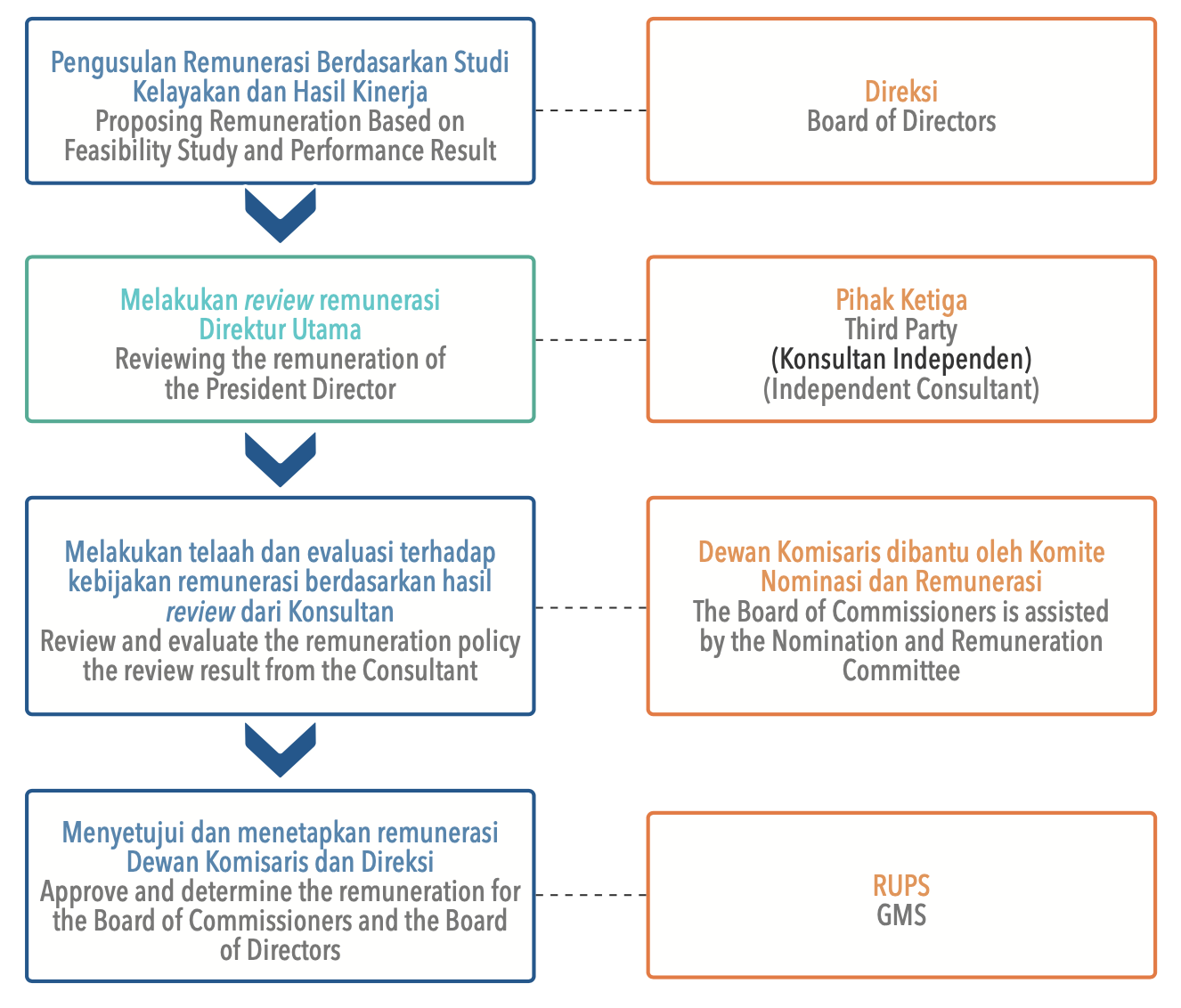

The procedure to determine the remuneration for Board of Commissioners and Board of Directors begins with the proposal stage submitted by the Board of Directors. The Board of Directors requests a third party (consultant) to review the remuneration of President Director. The consultant’s review results are submitted to the Board of Commissioners for recommendations. The Board of Commissioners, assisted by the Nomination and Remuneration Committee, reviews and evaluates the remuneration policy. The recommendation from Board of Commissioners is submitted to the Shareholders for approval at the GMS.

REMUNERATION DETERMINATION INDICATORS

The determination of income in the form of salary or honorarium, allowances and facilities that are permanent in nature is carried out by considering business scale factor, business complexity factor, inflation rate, the Company’s financial conditions and capabilities, and other relevant factors, and must not conflict with the laws and regulations.