FINANCIAL REVIEW

concession period, where one of the requirements is for implementing the practical method, from June 30, 2021 in the amendment to PSAK 73 Leases concerning Lease Concessions related to COVID-19 issued in May 2020, and June 30, 2022.

If the lessee applied the practical means of the Amendment in May 2020, they are required to continue to apply them consistently, for all leases with similar characteristics and under similar circumstances, using this Amendment. If the lessee did not apply the practical means of the May 2020 Amendment to eligible lease concessions, then the lessee cannot apply the practical means of the March 2021 Amendment.

The March 2021 Amendment can be applied retrospectively, recognizing the cumulative effect of the initial application of the Amendment as an adjustment to opening retained earnings at the beginning of the annual reporting period in which the lessee first applied the Amendment. However, the Group has not received any lease concessions related to COVID-19, but plans to implement practical means if applicable within the permitted application period.

However, the Group has not received any lease concessions related to COVID-19, but plans to implement practical means if applicable within the permitted application period.

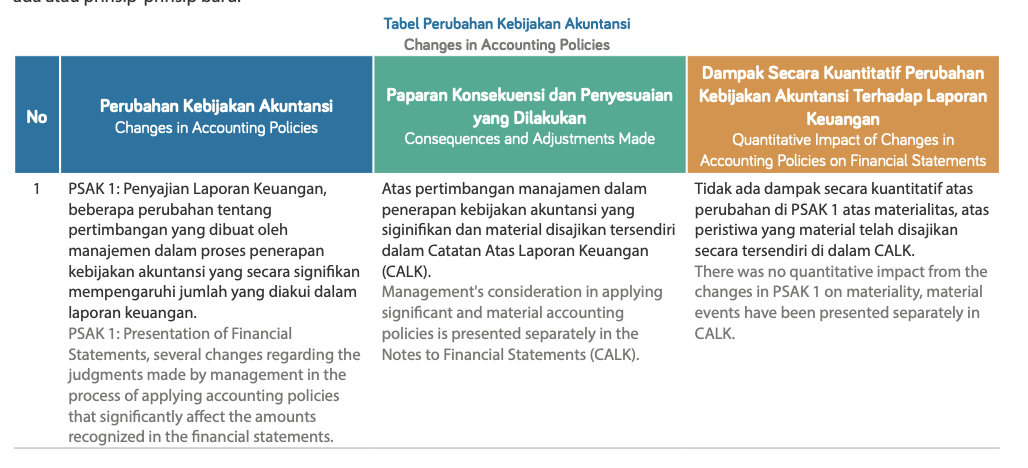

The following is a summary of information on the 2021 annual PSAK adjustments effective for annual reporting starting on or after January 1, 2021. The annual PSAK improvements are basically a series of amendments in a narrow scope that provides clarification so there will be no significant changes to existing principles. or new principles.